Making Information Make Sense

InfoMatters

Category: Information / Topics: History • Information • Statistics • Trends

COVID-19 Perspectives for June 2021

by Stu Johnson

Building article list (this could take a few moments)...

Building article list (this could take a few moments)...Posted: July 184, 2021

Celebrating a new sense of freedom for Independence Day 2021, we in America need to remind ourselves that the COVID pandemic is global and far from over…

Putting the COVID-19 pandemic in perspective (Number 12)

This series was spawned by my reaction to reporting early in the COVID-19 pandemic that focused on raw numbers. Big numbers are impressive, even frightening, but hard to comprehend. Rarely have we been given a context that helps lead to better understanding of the numbers or how to make comparisons between the U.S. and the rest of the world. This series turned into a monthly summary setting the U.S. numbers in global perspective. This analysis is based on data from worldometers.info, which monitors 215 countries. From those, I focus on details for 21 countries that have appeared in the top-10 of worldometers metrics since I started more detailed tracking in September 2020.

A note on reliability of data: It should be noted that the statistics reported by worldometers and other sources are only as good as the integrity of the reporting system in each country. China's statistics have increased so little since October that it is doubtful its numbers are accurate, so they are not included in some of the charts. Other countries have also had gaps in reporting, or made adjustments when admissions of underreporting have been made. There is still enough information to make trends evident. That is why I tend to round some numbers and watch for changes over two or three months rather than focusing on a single month, as significant as that may turn out to be.

Even though the U.S. may fully reopen this summer, these reports will continue as long as the pandemic persists around the world.

Report Sections:

• June at-a-glance

• The Continental View • USA Compared Other Countries

• COVID Deaths Compared to the Leading Causes of Death in the U.S.

• U.S. COVID Cases versus Vaccinations

• Profile of Monitored Continents & Countries • Scope of This Report

June-at-a-glance

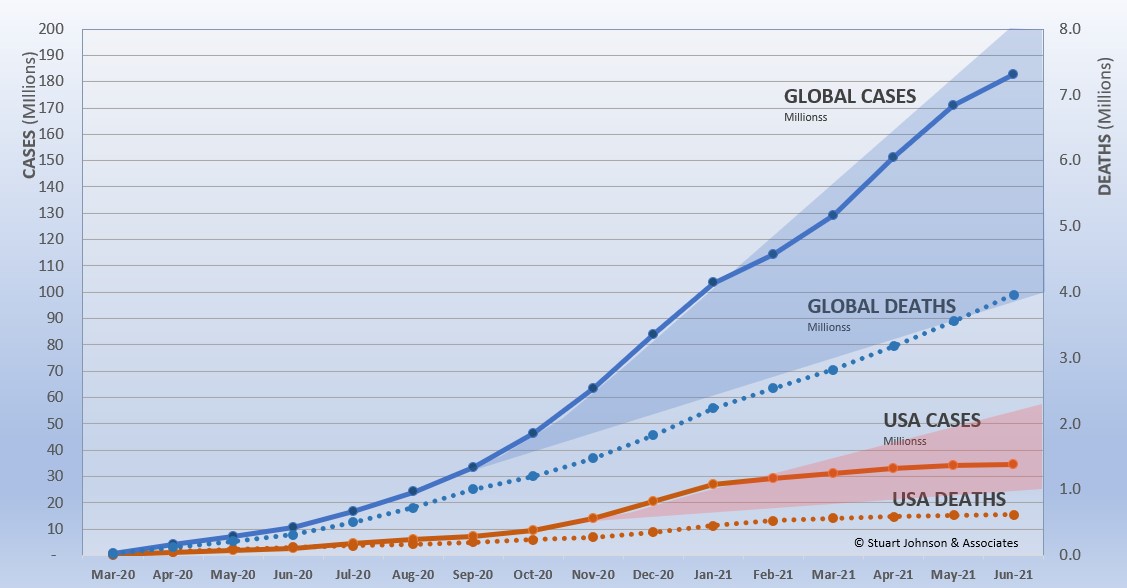

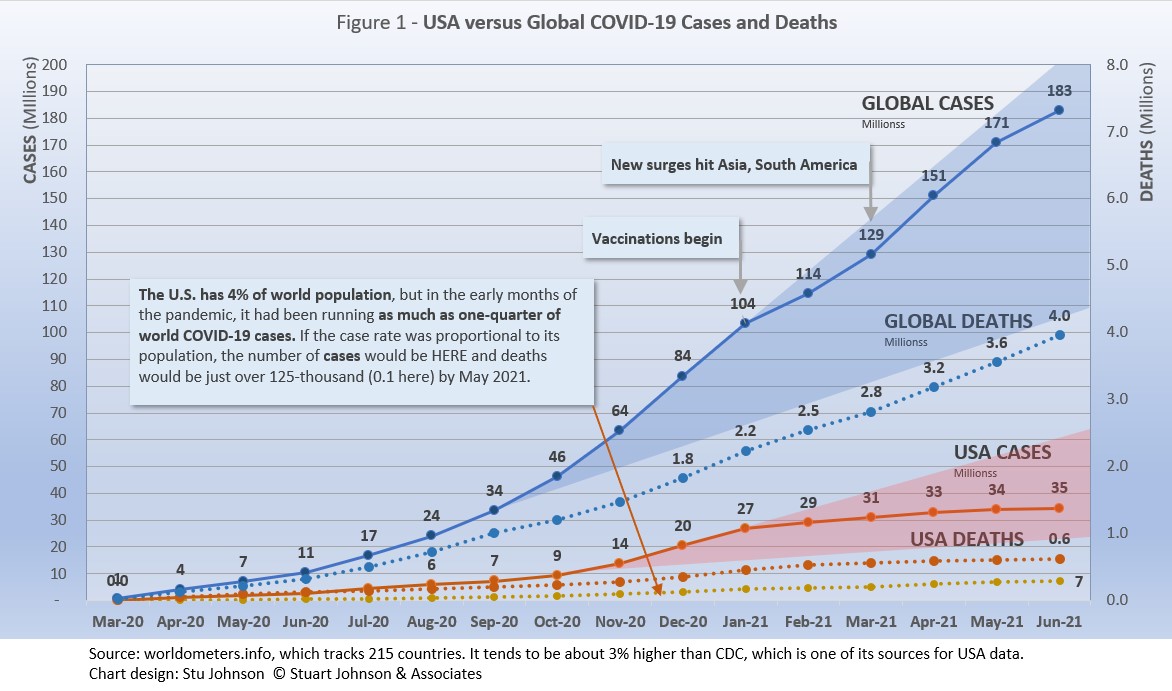

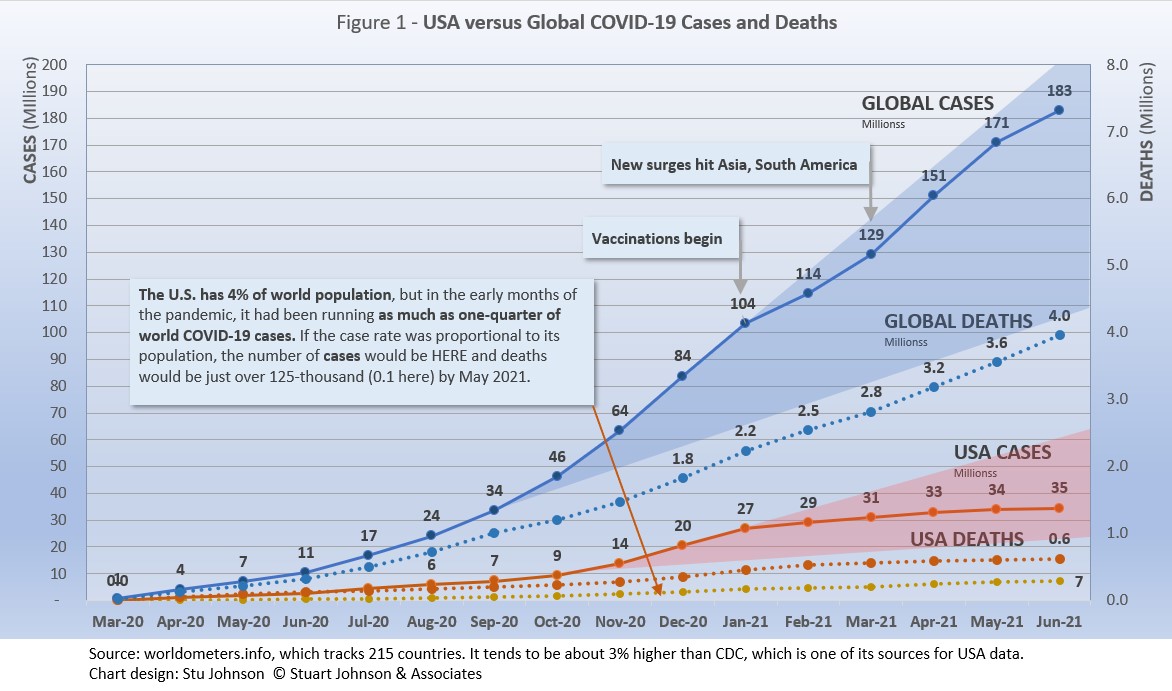

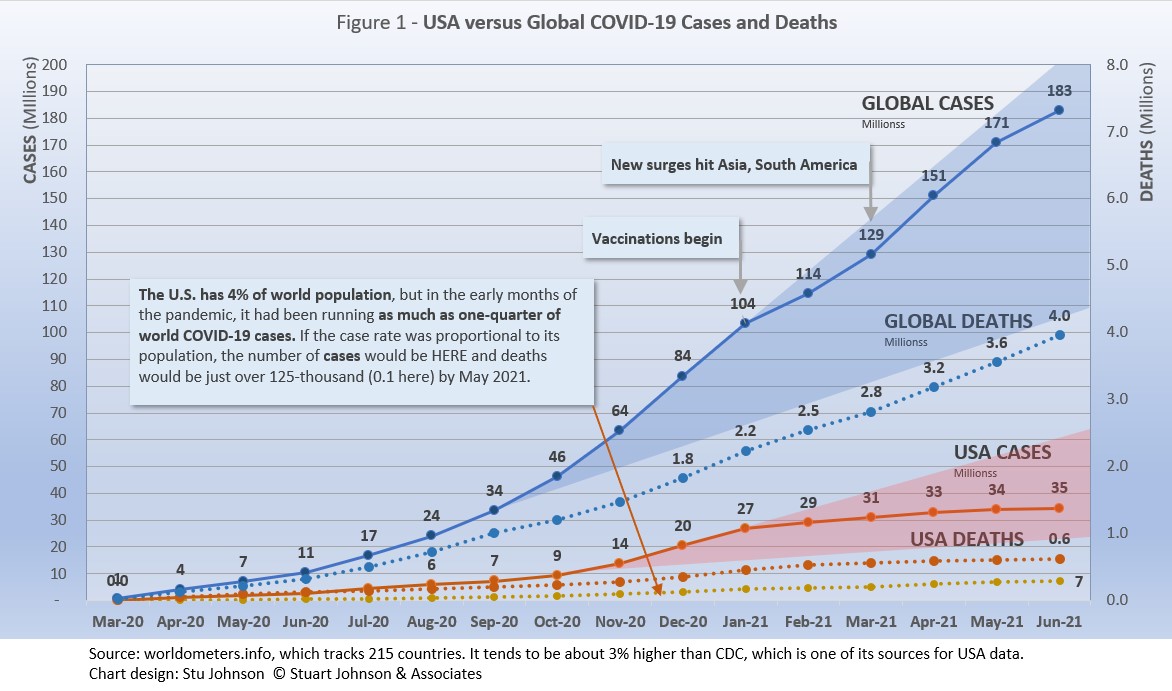

- COVID-19 continued to spread around the world, reaching 182-million cases by the end of June, up 7% from May. After a rapid increase from September through January, February appeared to "bend the curve" downward, with only a slight upward move in March. April brought surges, particularly in Asia and South America, which continued and even worsened in some locations in May, but slowed again in June. The level of reported cases represents 2.3% of the global population of 7.8-billion.

The blue "cone" in Figure 1 shows the possible high and low projection of global cases, with the bottom (roughly 110-million) representing the trajectory of the lower pace in late summer 2020 and the upper (approximately 215-million) representing a continuation of the surge from November 2020 through January 2021. You can see that the curve for global cases started to bend down in February 2021, but then resumed in March, following the slope of the November-January rate of increase. The growth did decelerate in June, but remains at the upper edge of the prediction cone. That was not the case with the U.S., which I'll get to below. - The pattern for deaths tends to lag behind cases by several weeks, and the global increase continues to fall below that of cases—dropping from a 23% increase in January to 11% in March, then turning back up slightly with a 13% increase in April that eased slightly to 11% by the end of June. You might expect that as cases decline, we would see the curve for deaths bend downward, even if a month or two later. If you look very closely at the trajectory of "Global Deaths" in Figure 1 you can see very slight slowing since January, but the curve has varied much less than that for cases.

- The U.S. continues to lead the world in the number of reported cases and deaths, and while it had 18.9% of global cases through June (with only 4% of world population), that is down from a high of 25.9% in January. Similarly, deaths have declined from 20.9% of the world total in September to 15.7% in June. As you will see in details to follow, while the U.S. outpaced everyone through the early months of the pandemic, the vast disparity is slowly shrinking. The projection cone surrounding USA Cases in Figure 1 shows a continued flattening of cases toward the bottom half of the cone (which extends from roughly 24- to 54-million) since vaccinations started in January. That is a striking contrast to the global cases curve and projection cone.

Figure 1 also shows how much lower cases would be—at about 7-million by now, instead of 35-million—if they were proportional to the global population,. It would also mean just over 154-thousand deaths instead of 620-thousand. One must be careful, however, in stating the situation so simplistically, as reality is a complex set of factors. Yet, it cannot be denied that the U.S. share to date has been extraordinarily high compared to other large countries.

- Countries to watch. Not yet in the list of countries monitored for this report, the weekly comparison report on worldometers gives a sense of hot spots to watch. At the end of June, this included surges in cases and/or deaths in Indonesia and South Africa, as well as Bangladesh, Malaysia, Philippines, Thailand, and Tunisia. If any of the these countries appear in the top-10 of cases or deaths for July, that will move them into the list of countries monitored for this report (currently at 21)..

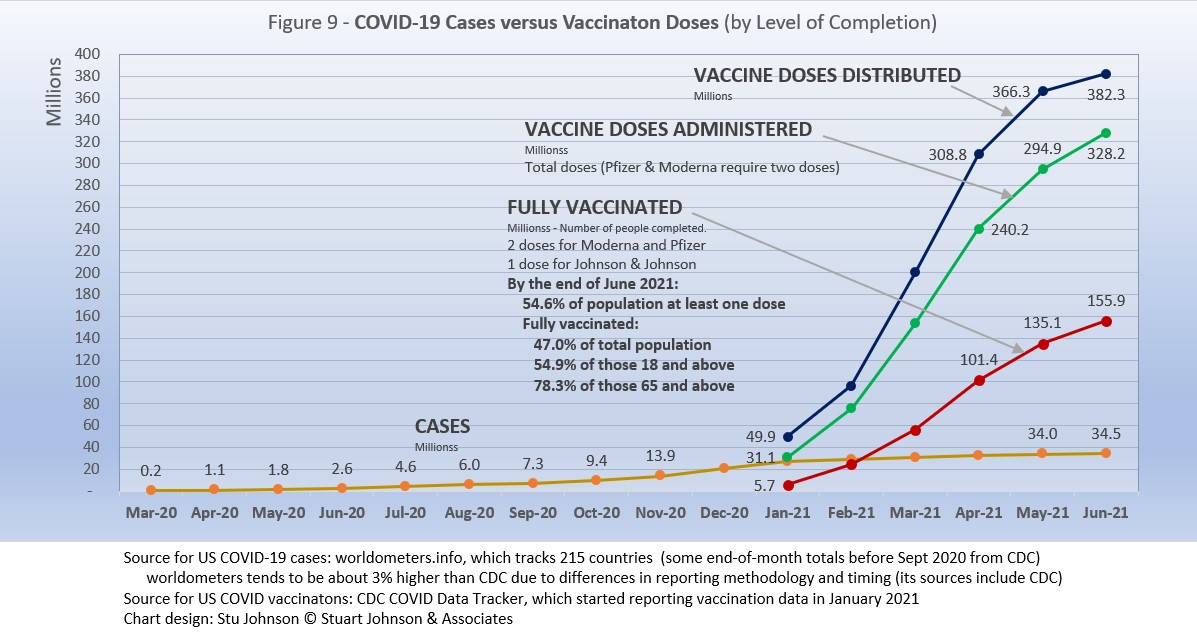

- With vaccinations, the U.S. continues to move ahead but the rocket-like trajectory through April has slowed considerably, like a rocket approaching orbit. The question is whether the slowing is coming too soon. By the end of June, a little over half of the U.S. population had received at least one dose (Moderna and Pfizer require two, Johnson & Johnson only one). 47.0% of the population was fully vaccinated (two weeks following the final shot), including 78.3% of those 65 and above. .

At the time of my last report, President Biden was hopeful that 70% of American's would have at least one dose of COVID vaccine by July 4. The target date and level were both symbolic and highly optimistic, coinciding with a major American summer holiday and a level often associated with herd immunity (though that applies to fully vaccinated people, not just a single dose). At the end of June, just over half (54.6%) of the population had received one dose and less than half (47.5%) were fully vaccinated.. Does the goal post need to be moved to Labor Day?

This leaves a conundrum: enough people are vaccinated to allow considerable relaxation of mitigation and a reopening of the economy; yet not having high enough levels of immunity makes the unvaccinated even more vulnerable to variants, such as delta, which risks a return to restrictions and lockdowns (something already faced in England and some parts of Europe).

The Continental View

While COVID-19 has been classified as a global pandemic, it is not distributed evenly around the world, though we began to see some shifts in patterns starting in April..

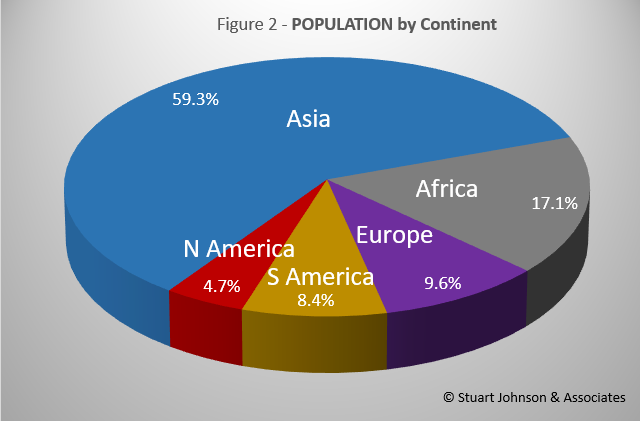

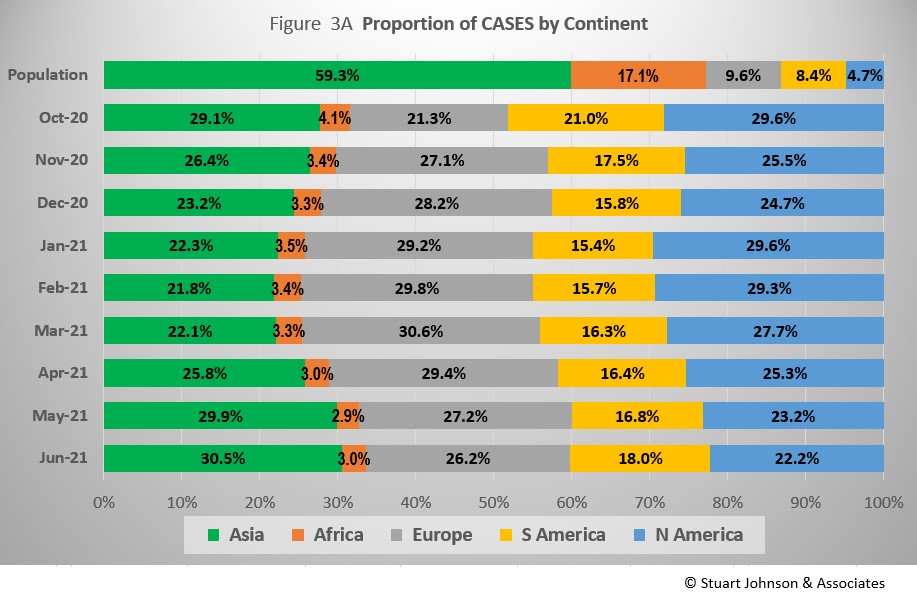

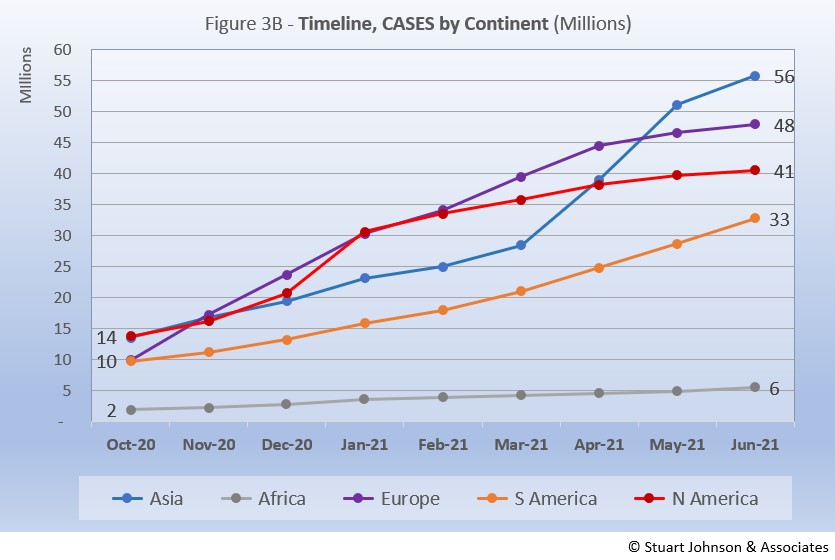

Asia accounts for 59.3% of the world's population (Figure 2), but had only 30.5% of COVID cases at the end June (Figure 3A)—affecting a mere 1.2% of its population (COVID cases have been reported for 2.3% of world population). After shrinking in proportion of cases since October, Asia has now reached its highest level since October (and statistics from China are likely badly under-reported). Where Asia and Africa combined represent about three-quarters (76.4%) of the world's 7.8-billion people, Europe, South America and North America still account for two-thirds of cases (66.4% - Figure 3A) and three quarters of COVID deaths (76.5% - Figure 4A).

Asia has the highest number of reported COVID cases, surpassing both Europe and North America as it experienced a dramatic upturn in April and May followed by slower but continued growth in June. South America remains in fourth place, but is slowly accelerating in cases each month. On the other hand, North America began to flatten its curve back in January (when vaccinations began), and Europe (slower to get vaccinations started) showed a slight increase in pace in March and April before decelerating in May and June. Africa, second by population, remains a loner, with an almost flat curve compared to the other four large continents. (Oceana's population is too small to be statistically significant, so it is not included in my analysis).

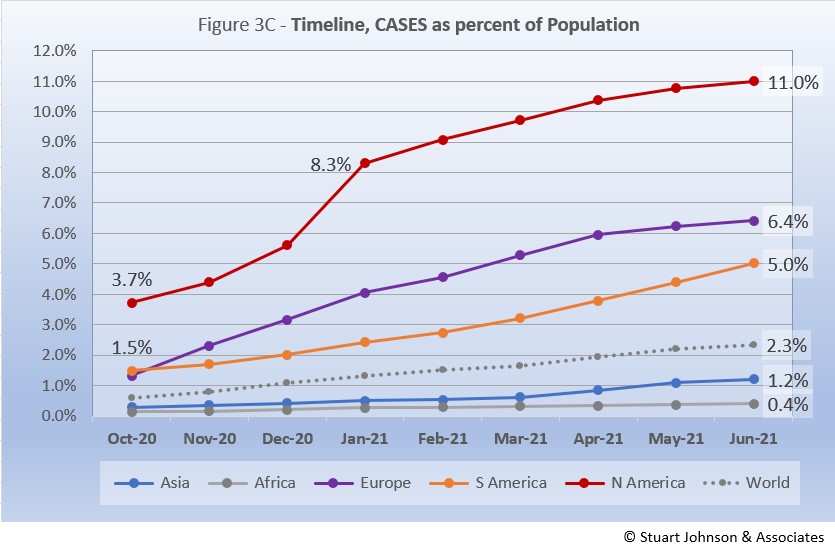

Remembering proportionality, the raw numbers of Figure 3B can be deceptive. Figure 3C gives a more realistic picture of impact by translating raw case numbers to percentage of population.

After a sharp increase in January, North America has slowed down in monthly growth, with May and June much closer to the global pace. That still leaves North America far above the other continents, with one in ten (11%) reported as having contracted COVID. Even if it goes flat, with virtually no further increases in cases, the likelihood of any other continent matching it in proportion of cases is extremely low.

Europe has slowed slightly below the North America and global pace. South America remains above the global rate, increasing slightly each month.

Asia and Africa remain below Global levels, though Asia showed an increase in its pace for April and May before slowing slightly in June. Despite the reports of COVID surges in India and other parts of Asia similar to what Italy experienced at the beginning of the pandemic, the sheer size of the continent means it can absorb a lot of growth in cases before it causes a dramatic bend in the curve (as seen in North America in January).

This is also the case as more recent reports of surges began to emerge from Africa, particularly South Africa. Yet, Africa reported only 5.5-millon cases, 0.4% of its population of 1.3-billion—the same proportion as last month, despite reports of surges.

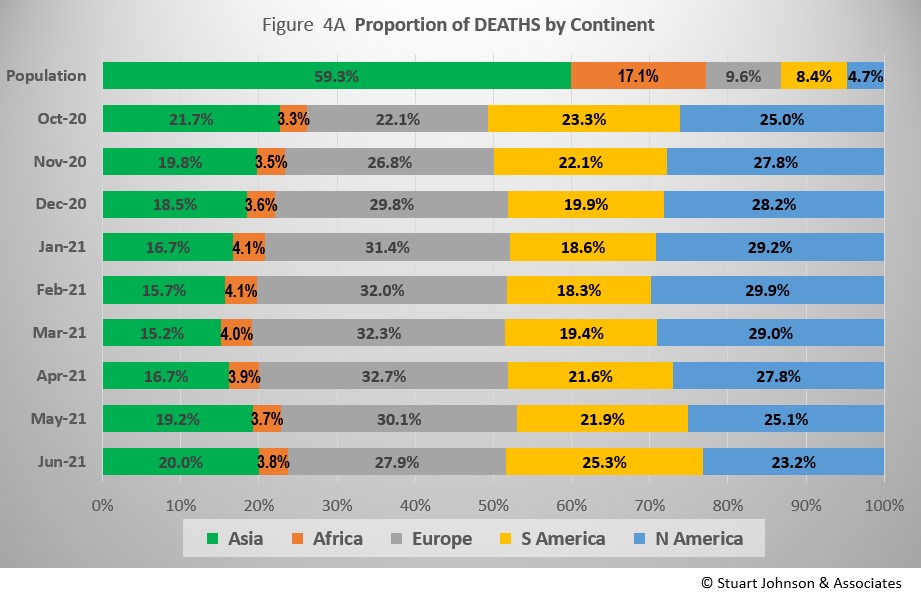

The proportion of deaths between continents is even more distorted than that of cases. Figure 4A shows the steady increase in the proportion of deaths in Europe and the Americas through April. June ended with Asia and Africa (76.4% of world population) accounting for 23.8% of COVID deaths.

The growing crisis in India showed up in May deaths, with Asia hitting 19.2% and a slower increase to 20.0% in June (still below the high of 21.7% in October).

Africa was down slightly in May then up slightly in June, but still below its most recent high of 4.1% in January and February.

Europe went down for the second month in June, North America for the third consecutive month, but South America accelerated an increase that started slowly in March, growing by 3.4-points in June. Peru made corrections to its death count in June that represents a big part of the change in South American deaths this month (see more in the Countries analysis below).

The overall distribution for Deaths through June shows that while the trajectory lags behind cases and has progressed at a steadier rate, it does reflect the overall changes in Cases by continent.

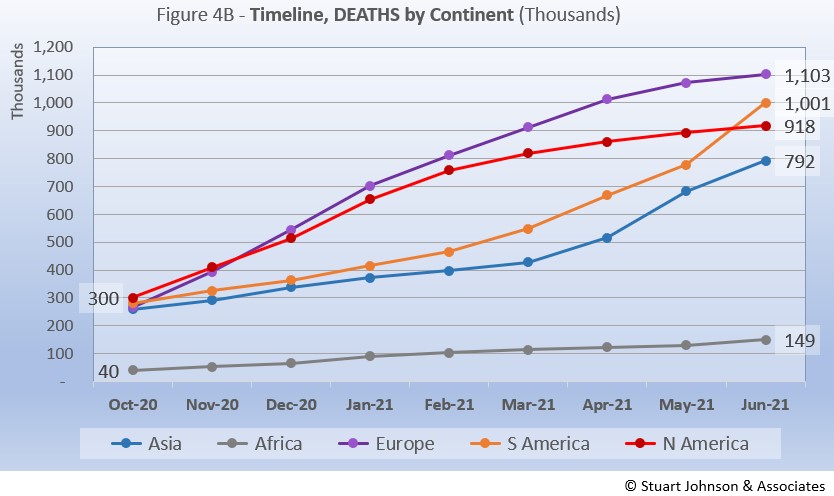

By numbers alone, we can say that COVID deaths reported for Africa continues at a very slow and steady pace. North America continues to slow down. Europe did indeed slow down in June, after a very slight downturn in deaths in May. Asia and South America began climbing in February and March, with Asia slowing slightly in June while South America climbed even higher, surpassing North America.

Back in October, Asia, Europe and the Americas were very close together in raw numbers. Europe and North America began a steady upward climb, well above the others, with Europe surpassing North America by December. January saw a slowdown for both, but North America slowed even more beginning in March, so the divide between them continued to grow. Europe did show a slight slowing in May, but became the first continent to surpass 1-million deaths (out of 3.6-million total)

South America started at a slower pace before bending upward more noticeably in March, then ending May poised to cross into second place as North America flattened. In June South America joined Europe in surpassing 1-millon deaths. Asia followed a similar pattern, though it was dropping further below South America until April when it started to rise, accelerating even more in May, then slowing in June. Asia could also pass North America in the next two or three months if present trends continue. Africa has remained the lowest and slowest in growth, ending June with 149-thousand deaths.

Comparison of U.S. with other Countries

Cases

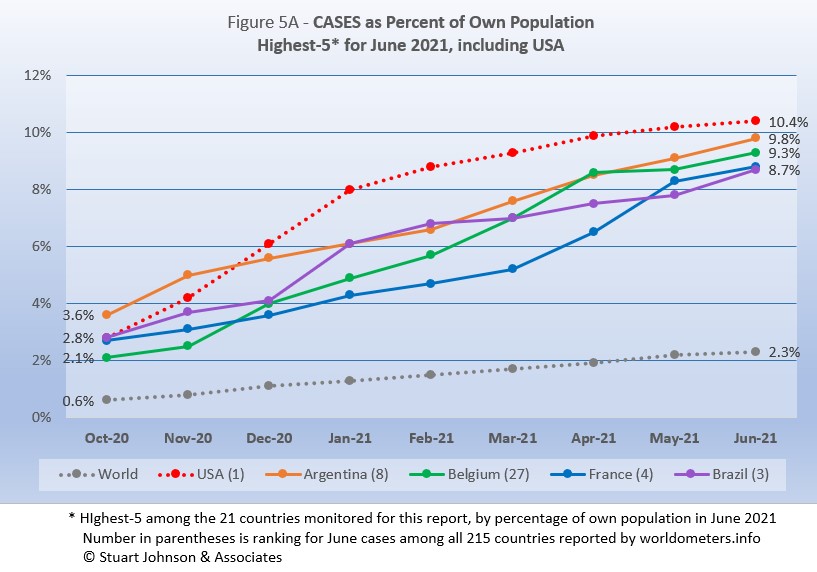

USA stays #1, Argentina moves up two to #2, Belgium and France each drop one to #3 and #4, Brazil takes place of Spain at #5 (Brazil and Spain have traded #5)

The top-5 by proportion of population with COVID cases, have progressed at a rate higher than the Global level, but have stayed within a fairly narrow band. The U.S. reached #1 by December, continuing to climb at a very fast pace until starting to slow in January, bringing it closer to the others by the end of June. The others meandered a bit, began to appear as if they were spreading out by March, but drew closer together by the end of June. All are significantly higher than the global level of 2.3% cases as proportion of a country's own population.

Another way to look at population proportion is the measure "1 in." The global figure of 2.3% means that 1 in 43 people in the world have been reported with COVID (and that only by official record keeping, not including any unreported and likely asymptomatic cases). For the U.S. it is 1 in

10. For Brazil it is 1 in 11.

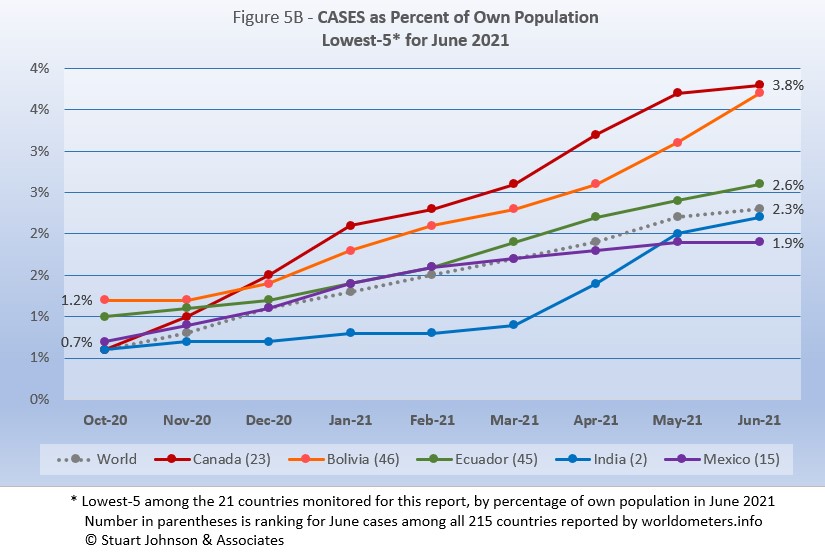

Canada replaces Iran in this month's list. The other four countries remain in the same order from May.

At the low end (Fig. 5B), the five lowest countries for cases by proportion of population are much closer to the global figure of 2.3% of population with confirmed cases of COVID-19 at the end of June.

While separated in May, Canada slowed while Bolivia continued to climb, so they ended up very close to each other at 3.8% and 3.7%. India had just moved into fourth place in May and even though it slowed in June, Mexico declined even more, widening their gap, though both are still under the Global level of 2.3% of their own population reported with COVID. Ecuador has stayed in the middle of the five, always above the Global level.

These countries represent a considerable spread in size, from India, the second largest country, to Bolivia, ranked number 50 of the 215 countries tracked by worldometers. For Canada, its 3.8% level represents 1 in 27 people, for India it is 1 in 45 and for Mexico it is 1 in 51.

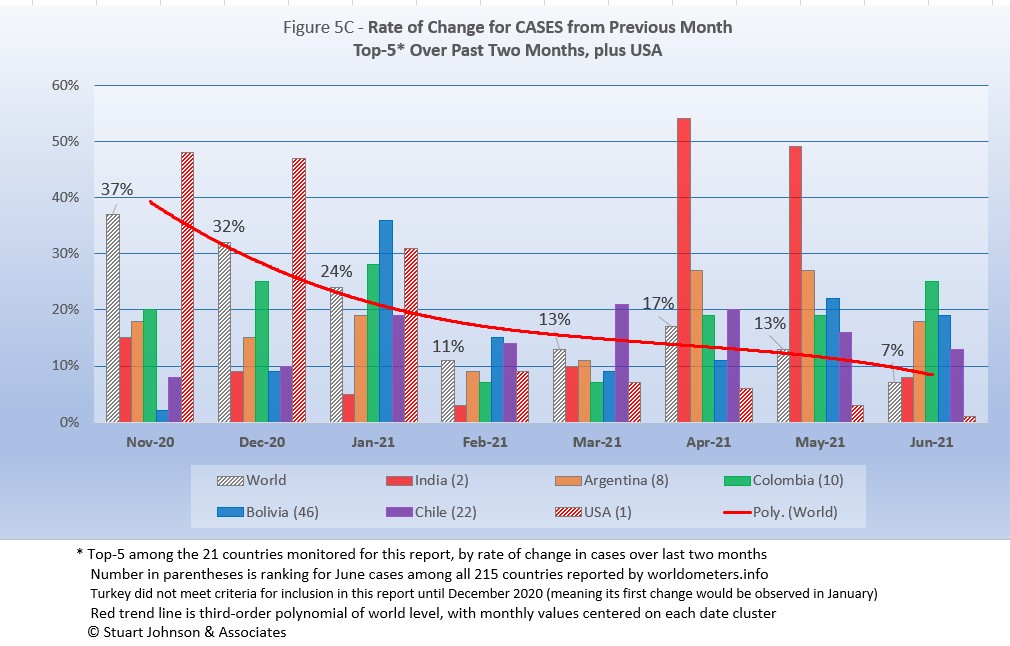

Because the size of countries makes the use of raw case numbers illusory, another measure I find helpful is the rate of change from month to month (Figure 5C).

For this chart, countries are selected based on the change over two-months (end of April to end of June for this report). Except for the U.S. (which will appear every month), the mix has changed since the last report, with a tilt toward South America. India remains, but Turkey and Iran dropped from the top-5, replaced by Bolivia and Chile.

The overall trend (red line)

continues to go down. An upward turn last month was smoothed out when June turned downward. (A polynomial trend line flexes as adjacent data points go up and down, so the leading edge (newest dates) can change the shape of the curve as new months are added). Note that some months appear "flatter" than others, with less variations between countries and with the global (world) number.

India started below the Global level, then spiked significantly above it in April and May. While dropping down to 8% in June, India remains strong on the two-month change criteria because of its 49% change in May (it had the highest single month change, at 54%, in April).

The other four of the top-5 are all from South America and significantly above the Global level for May and June. Colombia had the highest change in June at 25%, plus 19% increases in both April and May.

The U.S. started above the Global level from November through January, then has fallen further below it each month since.

Deaths

Because deaths as a percentage of population is such a small number, the "deaths per million" metric provides a comparable measure.

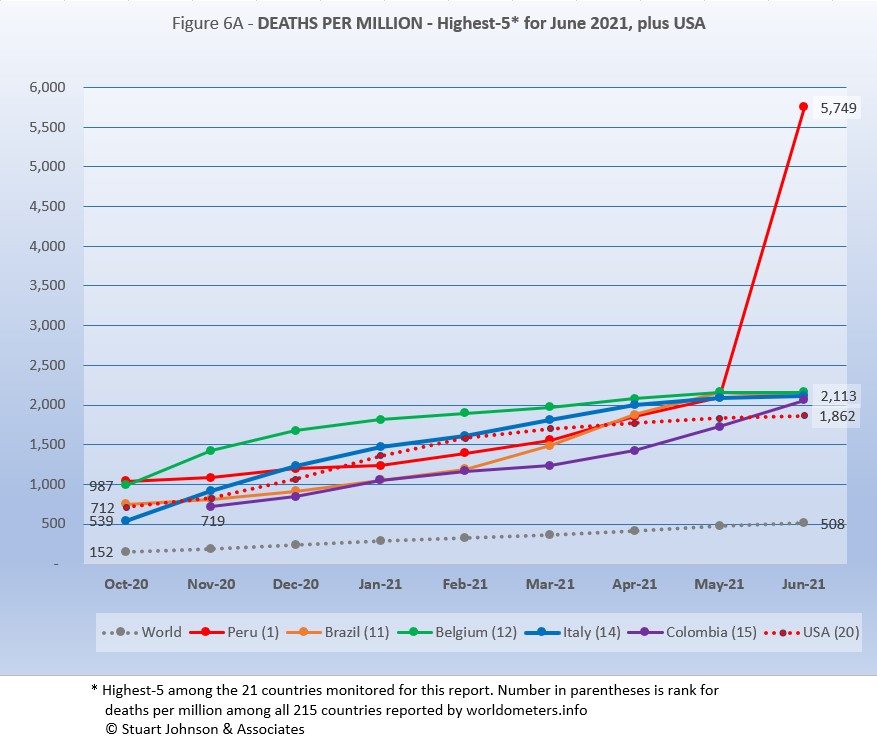

Colombia replaces the UK this month while Peru moves to #1 because of a very large correction to its death numbers in June. Brazil, Belgium and Italy return from last month.

As Figure 6A shows, because of the enormous correction in Peru's death count, its Deaths per Million number soars above the others. At 5,749 it is nearly double Brazil and ten times to Global level of 508. In the worldometer list of all countries. I had to expand the chart vertically so you could still see some variations in the remaining countries.

Since this analysis focuses on 21 countries that have been in the top-10 of cases and deaths, there are 9 other countries with Deaths per Million between Peru and Brazil. The second place country at the end of June was Hungary (population 9.6-million) with a Deaths per Million of 3,113.

The other countries on the chart, including the U.S. are all above the Global level, and (except for Peru) fairly close to each other—closer than they were from December through March, when they started to close in on each other.

As observed last month, the overall trend shown in Figure 6A is that the US and UK (no longer in the top-5 of monitored countries), with aggressive testing and vaccination, are beginning to slow the death rate, while Europe (represented by Belgium and Italy) are just now beginning to slow. Even without Peru's astonishing correction, South America (represented by Brazil and Colombia) remains a trouble spot, more so statistically than Asia or Africa.

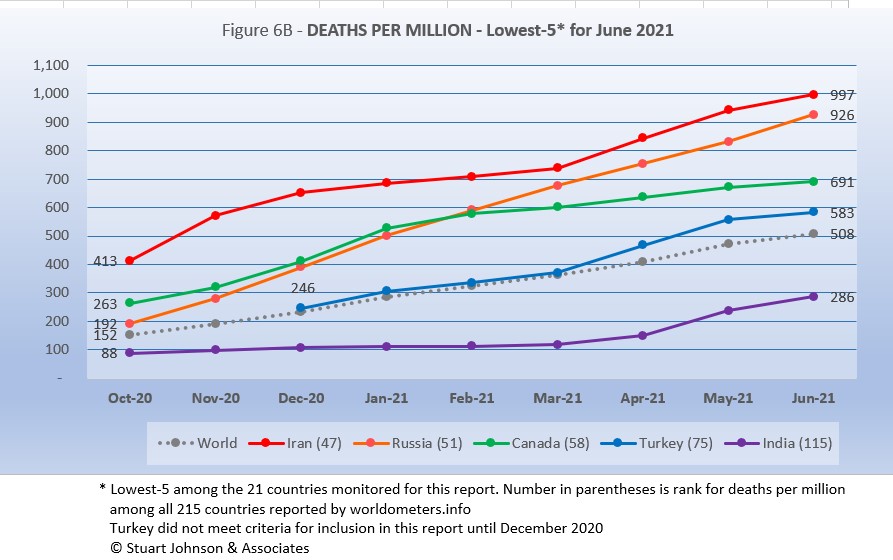

The same five countries, in the same order, continue in the lowest-5 in Deaths per Million (of the 21 countries tracked for this report).

Though starting to escalate in March, India remained well below the global rate of 508 deaths per million at the end of June. The other four countries are all above that rate. Canada has been slowing since February, Turkey rose in March and April, but slowed in June. Otherwise, Iran and Russia continue to climb above the Global rate.

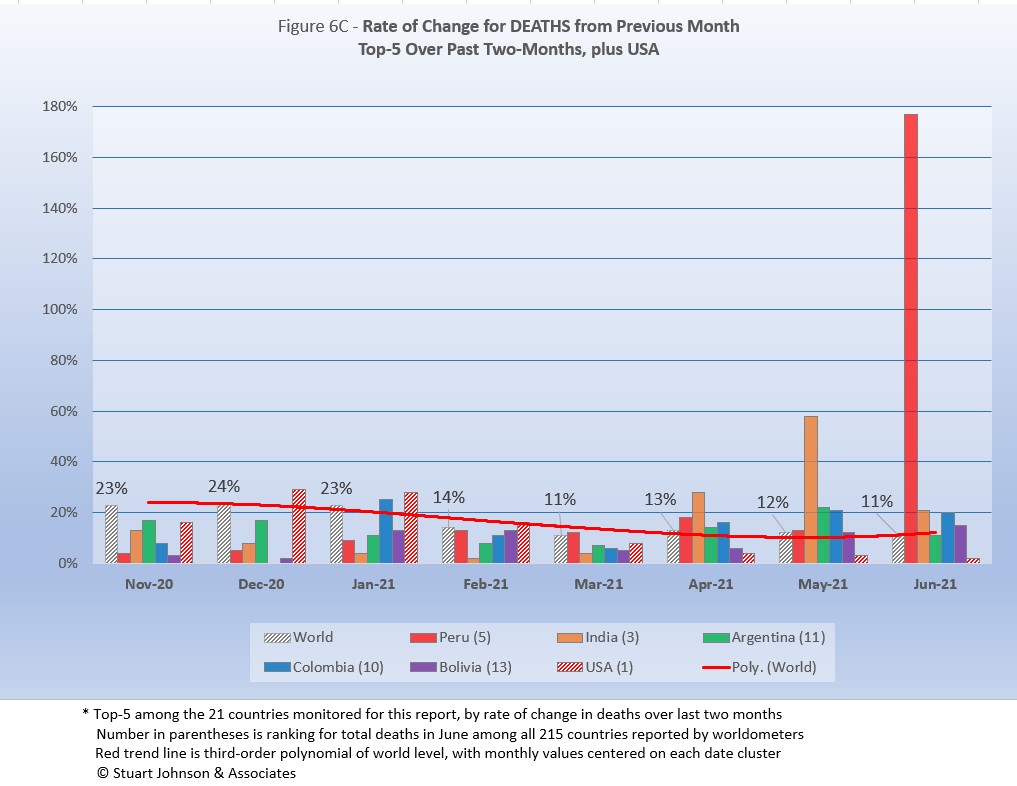

As with the comparable chart for Rate of Change for Cases (Figure 5C), countries are selected based on the change over two-months (end of April to end of June for this report) in reported COVID deaths. Except for the U.S. (which will appear every month), the mix has changed since the last report, with Peru thrust into the lead with its huge correction of reported deaths, a 177% change from May. Bolivia also joined the top-5, with Turkey and Brazil dropping out.

The trend

in the rate of change in deaths (red line in Figure 6C) shows the delayed connection with cases. Monthly changes for cases trended down through May, then the 177% increase for Peru in June pushed the trend line slightly higher. (As mentioned with Rate of Change for Cases, the trend line is a polynomial that can change shape as new values are added at the most-recent end.)

An important comparison is individual countries each month against the global (World) level. As you can see, through March, with few exceptions, countries were below the Global level. That changed in April when four countries (Peru, India, Argentina, and Colombia) were all at or above the Global levell in May. For June all of the top-5, including Bolivia, were at or above the Global level.

The U.S. was higher than the Global level in December, January and February, then has been significantly lower since then, falling to a 1% change in June (over the number of deaths in May).

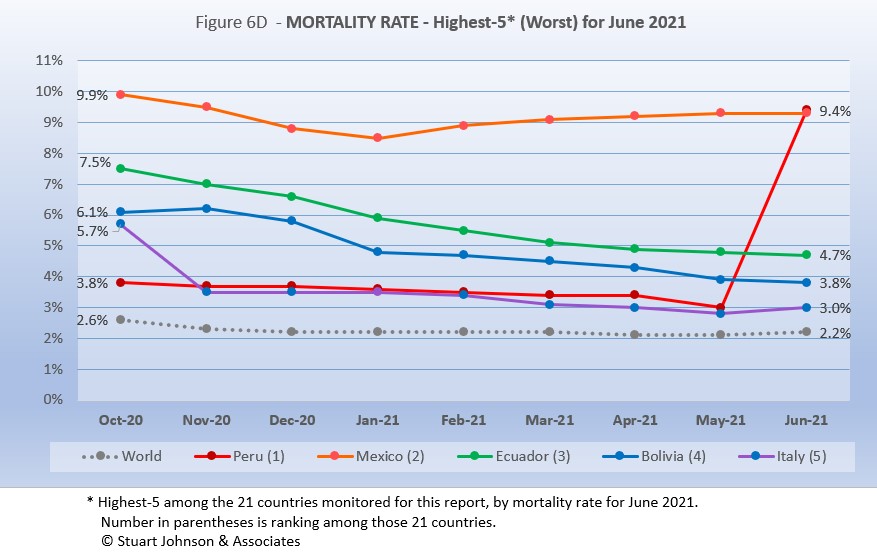

Mortality Rates (percentage of deaths against reported cases) have been slowly declining. This is not surprising as several factors came into play: the ratio of community spread versus outbreaks (nursing homes, similar confined settings) increased, lessons being applied to treatment, increased testing (which would expand the spread between reported cases and deaths), and increasing vaccinations since January (though that should impact both cases and deaths).

The top-5 in mortality rate (among the 21 countries observed) stand out because for the most part they had not been showing up in other charts until the past few months. All five countries carried over from May, with Peru jumping from #4 to #1. Peru had, like most other countries, seen a declining mortality rate which spiked in June due to adjusted numbers to nudge past Mexico (9.4% versus 9.3%) to take the lead. Both now share the distinction of being double the rest of the top-5. Except for a very slight upward move for Italy in June, the overall trend for the other three (Ecuador, Bolivia and Italy) has been down, but all above the Global level.

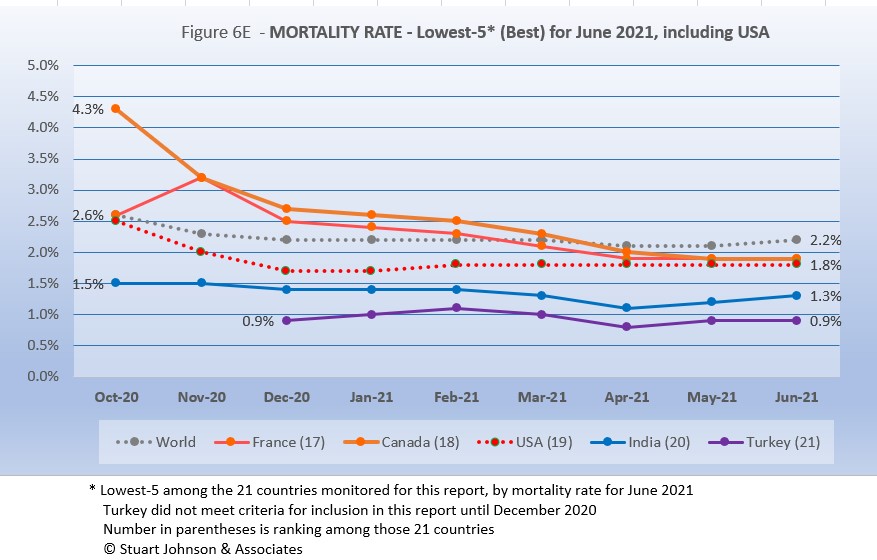

All five countries reappear this month, with Canada and France switching places.

France and Canada, continue to decline. The U.S. has leveled off at 1.8% for five straight months. India was trending down, then started a very slow increase in April. Similarly, Turkey hit a low in April, came up slightly in May, but stayed at 0.9% in June. All five were below the Global level of 2.2% in June.

How real is the threat of death from COVID? That's where successful mitigation comes in. Worldwide, by June, 1 in 1,976 people have died from COVID. In the U.S., while the mortality rate is low, because the number of cases is so high, 1 in 538 have died through June 2021. With low mortality, the U.S. should have been able to keep deaths much lower, but the extraordinarily high number of cases means more deaths. Without a better-than-global mortality rate, the U.S. death rate would be far higher. Compared to the 1918 pandemic, it could be ten times worse. The response of the health care system is part of keeping mortality down, but it's far too early to detail the cause for that positive piece of the COVID picture in the U.S. Even at the global mortality rate of 2.2%, the U.S. would have had 759-thousand deaths (for 34.5-million cases) by the end of June, instead of 620-thousand.

Tests

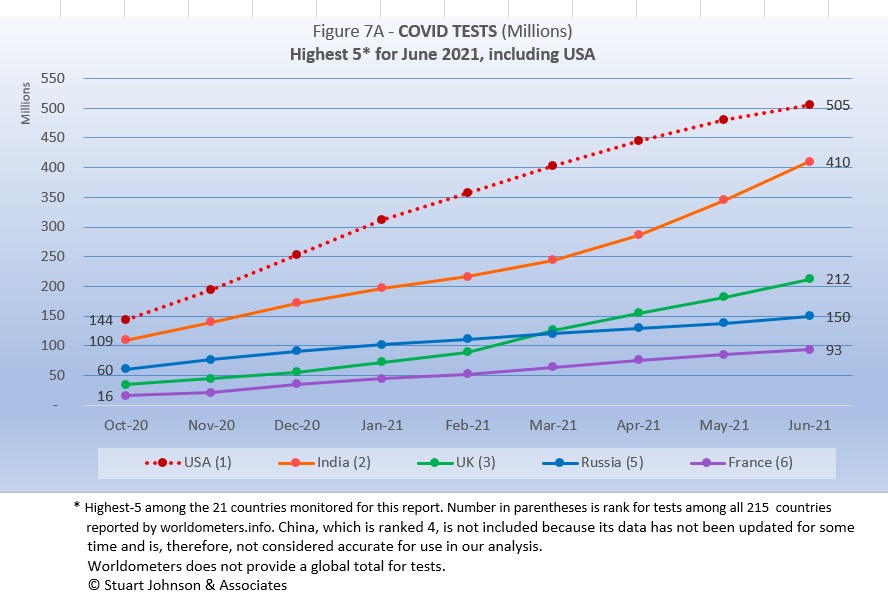

The same five countries remain on top in COVID testings, in the same order as May.

The U.S. remains ahead of other countries in reported COVID tests administered, at 505-million, 17% ahead of India, but that has narrowed from 39% last month and 56% in April. UK continues at the pace it set with an upturn in February, having moved past Russia in March. Russia and France continue on a steady upward path.

These are raw numbers, so it is important to recognize the size of the country. It is also the case that COVID tests can be administered multiple times to the same person, so it cannot be assumed that the U.S. has tested almost all of its population of some 330-million. Some schools and organizations with in-person gatherings are testing as frequently as once a week or more for those who are not yet fully vaccinated. That's a lot of testing!

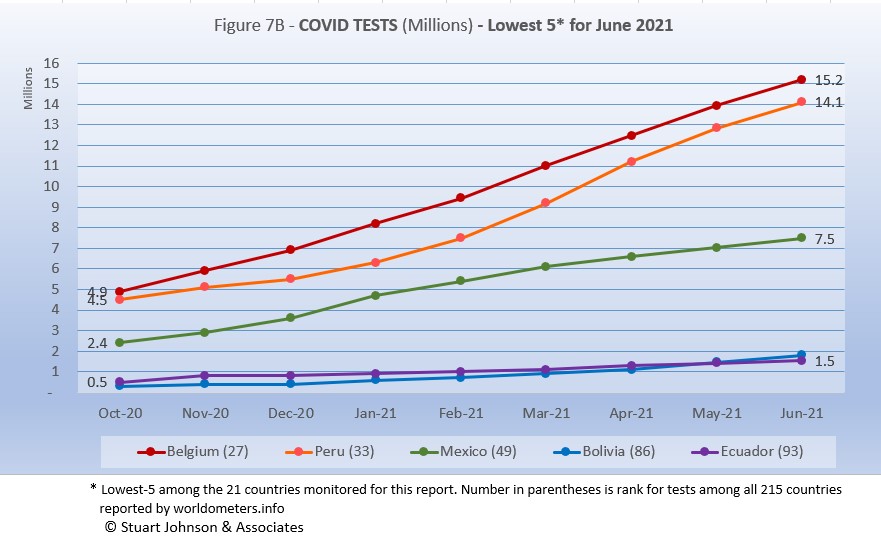

Belgium traded places with Argentina, but the other four countries reappear in the same order. .

There is tremendous disparity between countries in terms of testing. Except for Belgium, the other four countries (among the 21 monitored) with the lowest reported number of tests are in South America.

Peru (14.1-million tests for its 32.9-million population) is well below Canada (37.6-million tests for its 37.7-million population). Ironically, even though they both fall in the bottom-5 by number of tests reported, Bolivia, with a population of 11.7-million has tallied 1.5-million tests, while Belgium, with 11.6-million people, has reported ten times that number, with 15.2-mllion tests.

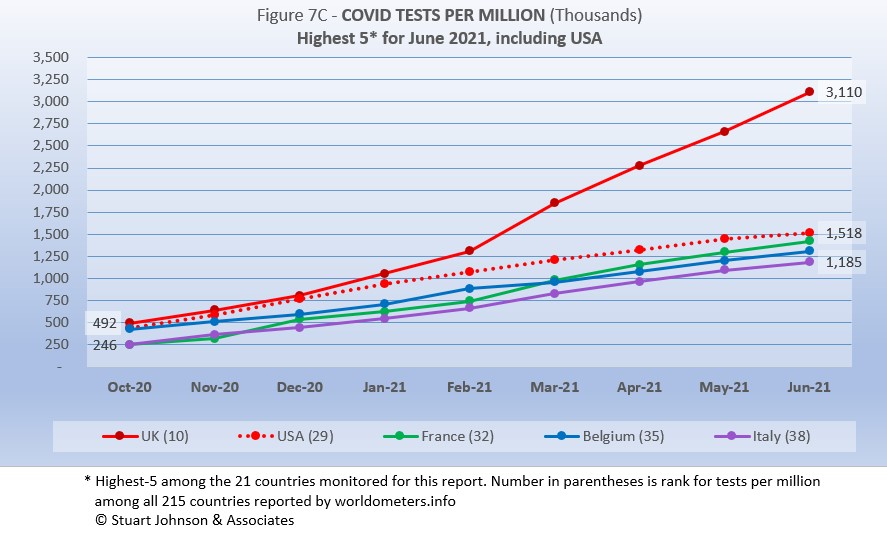

Tests per million adds another perspective. Fig. 7C shows the five countries with the highest tests per million. All five appeared in the same order last month.

The UK, already the most aggressive in testing, increased its numeric lead each month since February, with a reported 3.11-million tests per million population in June, just over 3 tests per person. The U.S. continues on a straight line trajectory, reaching 1.52-million tests per million, more than one per person, with a very slight decline in June. France, Belgium and Italy track close to each other, all increasing their climb above 1-million tests per million in June. France, with some variance in its curve has wiggled its way from #5 to #3 since October, but the bottom four (of the top five) have tracked fairly close to each other in that time.

Anything over 1,000 represents more tests than people (1,000 on the chart actually means 1,000,000), but as mentioned above, that does not mean that everyone had been tested. Some people have been tested more than once, and some are being test regularly or with increased frequency.

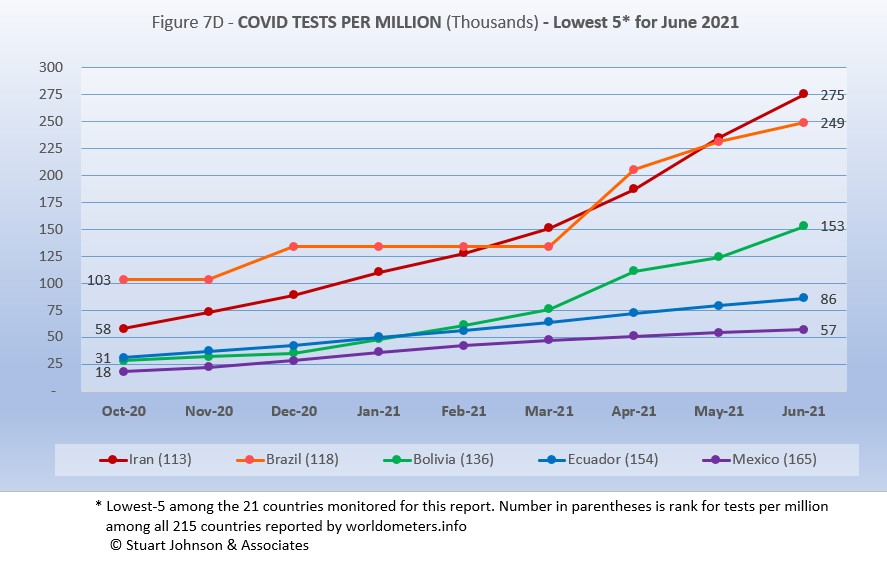

The same five countries appear as the lowest five in tests per million in the same order as May.

While still at the bottom of the 21 countries monitored for this report, Iran and Brazil have made the most substantial progress, Iran in a steady and slowly accelerating curve, Brazil in more halting fashion that may indicate inconsistencies in reporting. Bolivia began to accelerate in March, so it now nearly double Ecuador which has moved more slowly steadily. Also taking a slow and steady approach is Mexico, with the lowest level of tests reported.

While improvement is evident in all five, the equivalent proportion of tests to population remains very low, from roughly 6% to 28%. This illustrates the arguments over inequity in resources among countries.

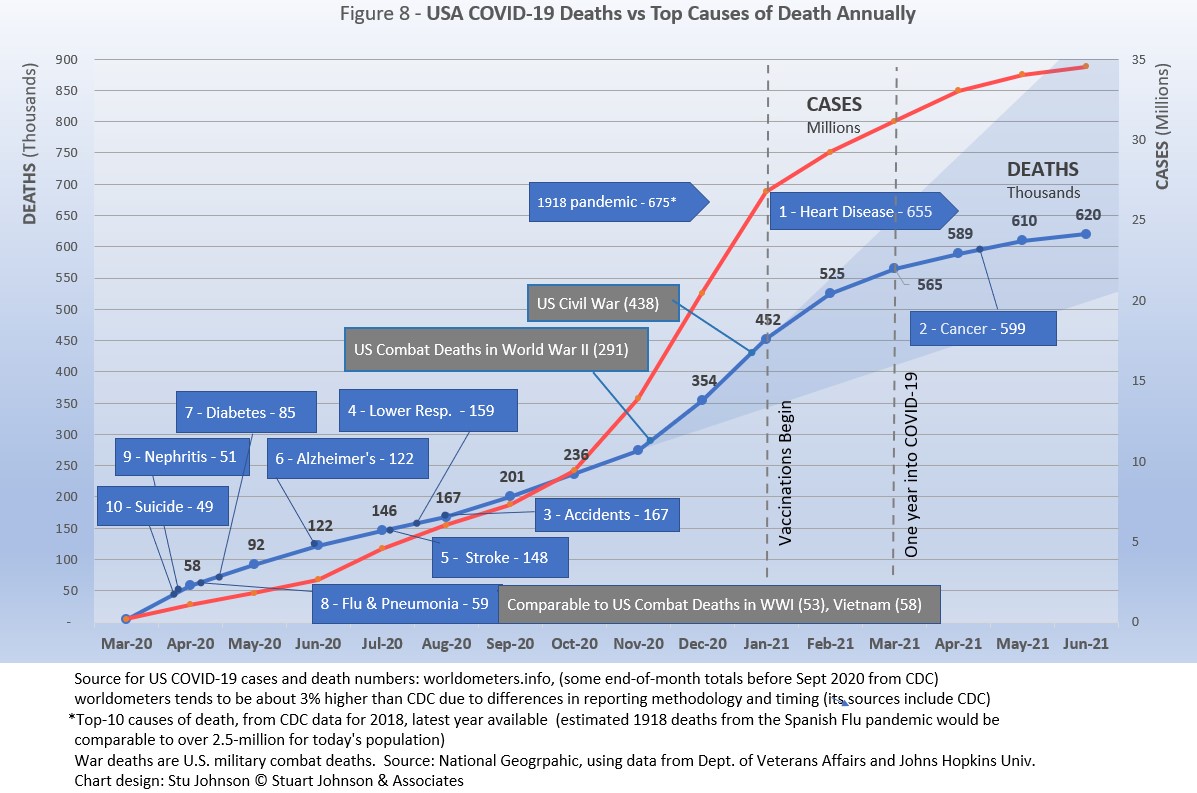

Causes of Death in U.S.

Early in the reporting on COVID, as the death rate climbed in the U.S., a great deal of attention was given to benchmarks, most notably as it approached 58,000, matching the number of American military deaths in the Vietnam War. At that time, I wrote the first article in this series, "About Those Numbers," in which I looked at ways of viewing the data, which at the time of that writing in May 2020 was still focused on worst-case models and familiar benchmarks, like Vietnam. Part of my approach in that article was to put the U.S. COVID deaths on a timeline against not only mileposts like war deaths or significant numbers (i.e., every 50,000 or 100,000), but against the reality of the top-10 causes of death each year, numbers available from the CDC.

Figure 8 shows the number of U.S. COVID cases and deaths against the top-10 causes of death reported by CDC for 2018 (the latest data available), along with several other mileposts from wars and the 1918 pandemic. Notice that for nearly nine months, the curve for deaths was increasing at a faster rate than cases. Then, starting in October 2020 the curve for cases took a decided turn upward, while deaths increased at a more moderate pace. (This month, I placed cases above deaths on the chart, which better matches the reality that deaths are a portion of cases, even though separate scales are used for each. That also allows the prediction cone to come closer to hitting its upper limit on the chart).

Most media sources reported that the U.S. would pass 500,000 deaths on February 22, 2021. The CDC reported 497,415 deaths on February 21, while worldometer.info was already reporting 512,068. As mentioned elsewhere in this report, worldometer tends to be about 3% ahead of CDC and Johns Hopkins, a matter of a few days difference in data collection. At any rate, it is clear that February 2020 saw the U.S. death toll from COVID pass the 500,000 mark, headed toward 600,000.

The February slowdown in cases was met by a barely perceptible slowdown in deaths, because as pointed out earlier, changes in deaths trail changes in cases. That trend continued in March and bent downward even more in April. In fact, if the trajectory from November to February had continued (the upper edge of the blue cone), we would have seen close to 925-thousand deaths by the end of June. The total of 610-thousand at the end of May did pass 599-thousand, the number who died from Cancer in 2018. The next benchmark is the #1 cause of death, heart disease, at 655-thousand. We're close, but the curve is bending down, so how long will it take to get there?

The latest "Ensemble Forecast" from CDC suggests this for the immediate future (even though worldometers is already ahead of this prediction, it is within the 3% difference between the two sources):

...the number of newly reported COVID-19 deaths will likely decrease over the next 4 weeks, with 600 to 2,900 new deaths likely reported in the week ending July 24, 2021. The national ensemble predicts that a total of 608,000 to 615,000 COVID-19 deaths will be reported by this date..

Note: As I've referenced in the notes for several charts, the data from worldometers.info tends to be ahead of CDC and Johns Hopkins by about 3%, because of reporting methodology and timing. I use it as a primary source because its main table is very easy to sort and provides the relevant data for these reports.

Perspective

The 1918-19 Spanish Flu pandemic is estimated to have struck 500 million people, 26.3% of the world population of 1.9-billion at that time. By contrast, we're now at 2.3% of the global population. Deaths a century ago have been widely estimated at between 50- and 100-million worldwide, putting the global mortality rate somewhere between 10 and 20-percent. It has been estimated that 675,000 died in the U.S.

IF COVID-19 hit at the same rate as 1918, we would see about 2-billion cases worldwide by the time COVID-19 is over, with the global population now at 7.8-billion—four times what it was in 1918. There would be 200- to 400-million deaths. The U.S. is estimated to have had 27-million cases (one-quarter of the population of 108-million) and 675,000 deaths. Today, with a population of 330-million (a three-fold increase from 1918) this would mean more than 80-million cases, and 2- to 4-million deaths.

However, at the present rate of confirmed cases and mortality while the total number of global cases could approach 500 million or more—comparable to 1918 in number, that would be one-quarter of 1918 when taking population growth into account . .. and assuming the pandemic persists as long as the Spanish Flu, which went on in three waves over a two year period. At the present rate of increase (approximately 12-million cases per month) it would take another 27 months to reach 500-million, well into 2024.

If the total number of cases globally did approach 500-million, using the global mortality rate of 2.2% in June, there would be roughly 11-million deaths worldwide, tragic but far below the number reported for 1918 (50-million) with an even wider gap (200 million) when taking population growth into account.

With vaccination in progress and expected to be completed in the U.S. by the end of summer, the end of COVID-19 could come sooner. Like 1918, however, there could be complicating factors such as the growing number of mutations that are more highly transmissible (but not necessarily more deadly). It seems unlikely that the number of cases worldwide will reach 500-mllion, unless current and potential hot spots in Asia, South America and Africa continue to grow. While we in the U.S. think the end of the pandemic is in sight (or already here), it is still too early to make predictions on the duration and severity of the COVID-19 pandemic globally.

The contrast demonstrates the vast difference in scale between the Spanish Flu pandemic a century ago and COVID-19 even a year-and-a-half in. Key differences are the mitigation efforts, available treatment today (though still leaving the health care system overwhelmed in some areas), and the beginning of vaccine distribution. In addition, in 1918 much of the world was focused on a brutal war among nations (World War I) rather than waging a war against the pandemic, which ran its course and was undoubtedly made much worse by the war, with trans-national troop movements, the close quarters of trench warfare, and large public gatherings supporting or protesting the war.

Vaccinations in the U.S.

With remarkable speed (it usually takes years to develop vaccines), two COVID vaccines were granted emergency approval for use in the U.S. starting in January—the one by Pfizer requires super-cold storage, which limits its deployment. The other, by Moderna, requires cold storage similar to other vaccines. Both of these require two doses, which means that vaccine dosages available must be divided in two to determine the number of people covered. By my March report, Johnson & Johnson had been granted approval for a single-dose vaccine. The numbers in Figure 9 represent the status of all three vaccines as of June 30.

A person is considered "fully vaccinated" two weeks after the final (or only) vaccine dose; that means it can take a total of 5 or 6 weeks from the first of a two-dose vaccine to be fully vaccinated. (depending on the time between doses).

Early on (still somewhat evident in March) there was much anxiety about vaccine availability and scheduling appointments. That is behind us and vaccinations are readily available to most of the population (there will always be some disparities and trouble spots, but in general most people who want the vaccine can get it).

Now, the biggest concern is convincing the dubious, the deniers, and the resisters to get vaccinated and help the country reach herd immunity (about 70% of the population fully vaccinated). Some of the latest strategies to encourage vaccination is the provision of incentives, from free beer to lotteries for the fully vaccinated.

Vaccinating over 300 million people in the United States (much less a majority of the billions around the world) is a daunting task. It is a huge logistical challenge, from manufacture to distribution to administration. Yet, it remains amazing that any of this is possible so soon after the identification of the virus a year and a half ago.

There is a delicate balance between maintaining hope with the reality that this is a huge and complicated logistical operation that will take time, though that time is now measured in months instead of years. As the richer countries with access to more resources make progress, the global situation is raising issues of equity and fairness within and between countries.

Even as the U.S. and other countries launch large scale vaccine distribution to a needy world community, the immensity of the need is so great that a common refrain heard now is whether this aid is too little, too late. As COVID fades into a bad memory in countries able to provide help, will the sense of urgency remain high enough to produce the results needed to end this global pandemic?

We can grasp the hope that the end is in sight, but let's not throw it away by being foolhardy!

My wife and I have been fully vaccinated since mid-April. DuPage County, Illinois, where we live, has the highest vaccination rate in the Chicago area. The state of Illinois "re-opened" on June 11, meaning that most restrictions on those who are fully vaccinated have been dropped. We've been walking outdoors without masks, have been to a restaurant a couple of times with family, attend church in a more normal fashion, and welcome back the Wheaton Municipal Band, which canceled its 2020 season because of COVID.

Pete Friedman, the announcer for the band concerts has been coming out wearing a mask that he removes just before reaching the microphone. At each concert he has explained that he has been vaccinated but because of an auto-immune problem it was not effective, so he continues to wear the mask until the virus dies out or an effective solution for him is found. He asks people to respect those who still wear masks or want to maintain social distance for whatever reason—and the audience shows its appreciation and empathetic response..

As we approach the celebration of Independence Day with a new sense of personal freedom, it is important to realize that there is still danger that requires common sense. I'm thankful to live in an area that has shown a great deal of common sense and common purpose in getting through this pandemic.

Maintaining Perspective

In the tendency to turn everything into a binary right-wrong or agree-disagree with science or government, we ignore the need to recognize the nature of science and the fact that we are dealing with very complicated issues. So, in addition to recommending excellent sources like the Centers for Disease Control and Prevention (CDC), it is also wise to consider multiple qualified sources.

While there has been much focus placed in trusting "the science," it is important to recognize that science itself changes over time based on research and available data. In the highly volatile political atmosphere we find ourselves in (not just in the U.S., but around the world), there is a danger of not allowing the experts to change their views as their own understanding expands, or of trying to silence voices of experts whose views are out of sync with "the science" as reported by the majority of media outlets. In an earlier report, I mentioned the

Greater Barrington Declaration, currently signed by nearly 57-thousand medical & public health scientists and medical practitioners, which states "As infectious disease epidemiologists and public health scientists we have grave concerns about the damaging physical and mental health impacts of the prevailing COVID-19 policies, and recommend an approach we call Focused Protection."

For a personal perspective from a scholar and practitioner who espouses an approach similar to the Focused Protection of the Greater Harrington Declaration, see comments by Scott W. Atlas, Robert Wesson Senior Fellow at the Hoover Institution at Stanford University, in an article "Science, Politics, and COVID: Will Truth Prevail?"

Several months ago on SeniorLifestyle I posted an article by Mallory Pickett of The New Yorker, "Sweden's Pandemic Experiment," which provides a fair evaluation of the very loose protocols adopted by Sweden, essentially a variation of the "Focused Protection" approach. The "jury is still out" on this one, so judge for yourself whether Sweden hit the mark any better than the area in which you live.

How we evaluate the many approaches used to deal with COVID will determine how we prepare for and approach the next global event.

My purpose in mentioning these sources is to recognize that there are multiple, sometimes dissenting, voices that should be part of the conversation. The purpose of these monthly reports remains first and foremost to present the numbers about COVID-19 in a manner that helps you understand how the pandemic is progressing and how the U.S. compares to the world—and how to gain more perspective than might be gathered from the news alone.

Profile of Monitored Continents & Countries

(Data from worldometers.info).

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| WORLD | 7.82B | 100% | -- | -- | -- | |

| Top 10 Countries by Population, plus Five Major Continents See lists of countries by continent |

||||||

| - | ASIA | 4.64B | 59.3% | 150 | 51 countries | 32 |

| 1 | China | 1.44B | 18.4% | 153 | 61% | 38 |

| 2 | India | 1.38B | 17.7% | 454 | 35% | 28 |

| - | AFRICA | 1.34BM | 17.1% | 45 | 59 countries | 20 |

| - | EUROPE | 747.7M | 9.6% | 34 | 44 countries | 43 |

| - | S AMERICA | 653.8M | 8.4% | 32 | 50 countries | 31 |

| - | N AMERICA | 368.9M | 4.7% | 29 | 5 countries | 39 |

| 3 | USA | 331.5M | 4.3% | 36 | 83% | 38 |

| 4 | Indonesia* | 274.5M | 3.5% | 151 | 56% | 30 |

| 5 | Pakistan* | 220.9M | 2.8% | 287 | 35% | 23 |

| 6 | Brazil | 212.9M | 2.7% | 25 | 88% | 33 |

| 7 | Nigeria* | 206.1M | 2.6% | 226 | 52% | 18 |

| 8 | Bangladesh* | 165.2M | 2.1% | 1,265 | 39% | 28 |

| 9 | Russia | 145.9M | 1.9% | 9 | 74% | 40 |

| 10 | Mexico | 129.3M | 1.7% | 66 | 84% | 29 |

| *these countries do not appear in the details because they have not yet reached a high enough threshold to be included Other Countries included in Analysis most have been in top 10 of one or more categories covered in this report at least one month since October 2020 |

||||||

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| 17 | Turkey | 84.3M | 1.1% | 110 | 76% | 32 |

| 18 | Iran | 83.9M | 1.1% | 52 | 76% | 32 |

| 19 | Germany | 83.8M | 1.1% | 240 | 76% | 46 |

| 21 | United Kingdom | 67.9M | 0.9% | 281 | 83% | 40 |

| 22 | France | 65.3M | 0.8% | 119 | 82% | 42 |

| 23 | Italy | 60.4M | 0.8% | 206 | 69% | 47 |

| 29 | Colombia | 50.9M | 0.7% | 46 | 80% | 31 |

| 30 | Spain | 46.8M | 0.6% | 94 | 80% | 45 |

| 32 | Argentina | 45.2M | 0.6% | 17 | 93% | 32 |

| 39 | Canada | 37.7M | 0.5% | 4 | 81% | 41 |

| 43 | Peru | 32.9M | 0.4% | 26 | 79% | 31 |

| 63 | Chile | 19.1M | 0.2% | 26 | 85% | 35 |

| 67 | Ecuador | 17.6M | 0.2% | 71 | 63% | 28 |

| 80 | Bolivia | 11.7M | 0.1% | 11 | 69% | 26 |

| 81 | Belgium | 11.6M | 0.1% | 383 | 98% | 42 |

Scope of This Report

What I track

From the worldometers.info website I track the following Categories:

- Total Cases • Cases per Million

- Total Deaths • Deaths per Million

- Total Tests • Tests per Million (not reported at a Continental level)

- From Cases and Deaths, I calculate the Mortality Rate

Instead of reporting Cases per Million directly, I try to put raw numbers in the perspective of several key measures. These are a different way of expressing "per Million" statistics, but it seems easier to grasp.

- Country population as a proportion of global population

- Country cases and deaths as a proportion of global cases and deaths

- Country cases as a proportion of its own population

- Cases and deaths expressed as "1 in X" number of people

Who I monitor

My analysis covers countries that have appeared in the top-10 of the worldometers categories since September 2020. This includes most of the world's largest countries as well as some that are much smaller (see the chart in the previous section).

This article was also posted on SeniorLifestyle, which I edit

Search all articles by Stu Johnson

Building article list (this could take a few moments) ...

Building article list (this could take a few moments) ...Stu Johnson is owner of Stuart Johnson & Associates, a communications consultancy in Wheaton, Illinois focused on "making information make sense."

• E-mail the author (moc.setaicossajs@uts*)* For web-based email, you may need to copy and paste the address yourself.

Posted: July 184, 2021 Accessed 3,841 times

![]() Go to the list of most recent InfoMatters Blogs

Go to the list of most recent InfoMatters Blogs

![]() Search InfoMatters (You can expand the search to the entire site)

Search InfoMatters (You can expand the search to the entire site)

Loading requested view (this could take a few moments)...

Loading requested view (this could take a few moments)...Hard-covered books break up friendships. You loan a hard covered book to a friend and when he doesn't return it you get mad at him. It makes you mean and petty. But twenty-five cent books are different.

InfoMatters

Category: Information / Topics: History • Information • Statistics • Trends

COVID-19 Perspectives for June 2021

by Stu Johnson

Building article list (this could take a few moments)...

Building article list (this could take a few moments)...Posted: July 184, 2021

Celebrating a new sense of freedom for Independence Day 2021, we in America need to remind ourselves that the COVID pandemic is global and far from over…

Putting the COVID-19 pandemic in perspective (Number 12)

This series was spawned by my reaction to reporting early in the COVID-19 pandemic that focused on raw numbers. Big numbers are impressive, even frightening, but hard to comprehend. Rarely have we been given a context that helps lead to better understanding of the numbers or how to make comparisons between the U.S. and the rest of the world. This series turned into a monthly summary setting the U.S. numbers in global perspective. This analysis is based on data from worldometers.info, which monitors 215 countries. From those, I focus on details for 21 countries that have appeared in the top-10 of worldometers metrics since I started more detailed tracking in September 2020.

A note on reliability of data: It should be noted that the statistics reported by worldometers and other sources are only as good as the integrity of the reporting system in each country. China's statistics have increased so little since October that it is doubtful its numbers are accurate, so they are not included in some of the charts. Other countries have also had gaps in reporting, or made adjustments when admissions of underreporting have been made. There is still enough information to make trends evident. That is why I tend to round some numbers and watch for changes over two or three months rather than focusing on a single month, as significant as that may turn out to be.

Even though the U.S. may fully reopen this summer, these reports will continue as long as the pandemic persists around the world.

Report Sections:

• June at-a-glance

• The Continental View • USA Compared Other Countries

• COVID Deaths Compared to the Leading Causes of Death in the U.S.

• U.S. COVID Cases versus Vaccinations

• Profile of Monitored Continents & Countries • Scope of This Report

June-at-a-glance

- COVID-19 continued to spread around the world, reaching 182-million cases by the end of June, up 7% from May. After a rapid increase from September through January, February appeared to "bend the curve" downward, with only a slight upward move in March. April brought surges, particularly in Asia and South America, which continued and even worsened in some locations in May, but slowed again in June. The level of reported cases represents 2.3% of the global population of 7.8-billion.

The blue "cone" in Figure 1 shows the possible high and low projection of global cases, with the bottom (roughly 110-million) representing the trajectory of the lower pace in late summer 2020 and the upper (approximately 215-million) representing a continuation of the surge from November 2020 through January 2021. You can see that the curve for global cases started to bend down in February 2021, but then resumed in March, following the slope of the November-January rate of increase. The growth did decelerate in June, but remains at the upper edge of the prediction cone. That was not the case with the U.S., which I'll get to below. - The pattern for deaths tends to lag behind cases by several weeks, and the global increase continues to fall below that of cases—dropping from a 23% increase in January to 11% in March, then turning back up slightly with a 13% increase in April that eased slightly to 11% by the end of June. You might expect that as cases decline, we would see the curve for deaths bend downward, even if a month or two later. If you look very closely at the trajectory of "Global Deaths" in Figure 1 you can see very slight slowing since January, but the curve has varied much less than that for cases.

- The U.S. continues to lead the world in the number of reported cases and deaths, and while it had 18.9% of global cases through June (with only 4% of world population), that is down from a high of 25.9% in January. Similarly, deaths have declined from 20.9% of the world total in September to 15.7% in June. As you will see in details to follow, while the U.S. outpaced everyone through the early months of the pandemic, the vast disparity is slowly shrinking. The projection cone surrounding USA Cases in Figure 1 shows a continued flattening of cases toward the bottom half of the cone (which extends from roughly 24- to 54-million) since vaccinations started in January. That is a striking contrast to the global cases curve and projection cone.

Figure 1 also shows how much lower cases would be—at about 7-million by now, instead of 35-million—if they were proportional to the global population,. It would also mean just over 154-thousand deaths instead of 620-thousand. One must be careful, however, in stating the situation so simplistically, as reality is a complex set of factors. Yet, it cannot be denied that the U.S. share to date has been extraordinarily high compared to other large countries.

- Countries to watch. Not yet in the list of countries monitored for this report, the weekly comparison report on worldometers gives a sense of hot spots to watch. At the end of June, this included surges in cases and/or deaths in Indonesia and South Africa, as well as Bangladesh, Malaysia, Philippines, Thailand, and Tunisia. If any of the these countries appear in the top-10 of cases or deaths for July, that will move them into the list of countries monitored for this report (currently at 21)..

- With vaccinations, the U.S. continues to move ahead but the rocket-like trajectory through April has slowed considerably, like a rocket approaching orbit. The question is whether the slowing is coming too soon. By the end of June, a little over half of the U.S. population had received at least one dose (Moderna and Pfizer require two, Johnson & Johnson only one). 47.0% of the population was fully vaccinated (two weeks following the final shot), including 78.3% of those 65 and above. .

At the time of my last report, President Biden was hopeful that 70% of American's would have at least one dose of COVID vaccine by July 4. The target date and level were both symbolic and highly optimistic, coinciding with a major American summer holiday and a level often associated with herd immunity (though that applies to fully vaccinated people, not just a single dose). At the end of June, just over half (54.6%) of the population had received one dose and less than half (47.5%) were fully vaccinated.. Does the goal post need to be moved to Labor Day?

This leaves a conundrum: enough people are vaccinated to allow considerable relaxation of mitigation and a reopening of the economy; yet not having high enough levels of immunity makes the unvaccinated even more vulnerable to variants, such as delta, which risks a return to restrictions and lockdowns (something already faced in England and some parts of Europe).

The Continental View

While COVID-19 has been classified as a global pandemic, it is not distributed evenly around the world, though we began to see some shifts in patterns starting in April..

Asia accounts for 59.3% of the world's population (Figure 2), but had only 30.5% of COVID cases at the end June (Figure 3A)—affecting a mere 1.2% of its population (COVID cases have been reported for 2.3% of world population). After shrinking in proportion of cases since October, Asia has now reached its highest level since October (and statistics from China are likely badly under-reported). Where Asia and Africa combined represent about three-quarters (76.4%) of the world's 7.8-billion people, Europe, South America and North America still account for two-thirds of cases (66.4% - Figure 3A) and three quarters of COVID deaths (76.5% - Figure 4A).

Asia has the highest number of reported COVID cases, surpassing both Europe and North America as it experienced a dramatic upturn in April and May followed by slower but continued growth in June. South America remains in fourth place, but is slowly accelerating in cases each month. On the other hand, North America began to flatten its curve back in January (when vaccinations began), and Europe (slower to get vaccinations started) showed a slight increase in pace in March and April before decelerating in May and June. Africa, second by population, remains a loner, with an almost flat curve compared to the other four large continents. (Oceana's population is too small to be statistically significant, so it is not included in my analysis).

Remembering proportionality, the raw numbers of Figure 3B can be deceptive. Figure 3C gives a more realistic picture of impact by translating raw case numbers to percentage of population.

After a sharp increase in January, North America has slowed down in monthly growth, with May and June much closer to the global pace. That still leaves North America far above the other continents, with one in ten (11%) reported as having contracted COVID. Even if it goes flat, with virtually no further increases in cases, the likelihood of any other continent matching it in proportion of cases is extremely low.

Europe has slowed slightly below the North America and global pace. South America remains above the global rate, increasing slightly each month.

Asia and Africa remain below Global levels, though Asia showed an increase in its pace for April and May before slowing slightly in June. Despite the reports of COVID surges in India and other parts of Asia similar to what Italy experienced at the beginning of the pandemic, the sheer size of the continent means it can absorb a lot of growth in cases before it causes a dramatic bend in the curve (as seen in North America in January).

This is also the case as more recent reports of surges began to emerge from Africa, particularly South Africa. Yet, Africa reported only 5.5-millon cases, 0.4% of its population of 1.3-billion—the same proportion as last month, despite reports of surges.

The proportion of deaths between continents is even more distorted than that of cases. Figure 4A shows the steady increase in the proportion of deaths in Europe and the Americas through April. June ended with Asia and Africa (76.4% of world population) accounting for 23.8% of COVID deaths.

The growing crisis in India showed up in May deaths, with Asia hitting 19.2% and a slower increase to 20.0% in June (still below the high of 21.7% in October).

Africa was down slightly in May then up slightly in June, but still below its most recent high of 4.1% in January and February.

Europe went down for the second month in June, North America for the third consecutive month, but South America accelerated an increase that started slowly in March, growing by 3.4-points in June. Peru made corrections to its death count in June that represents a big part of the change in South American deaths this month (see more in the Countries analysis below).

The overall distribution for Deaths through June shows that while the trajectory lags behind cases and has progressed at a steadier rate, it does reflect the overall changes in Cases by continent.

By numbers alone, we can say that COVID deaths reported for Africa continues at a very slow and steady pace. North America continues to slow down. Europe did indeed slow down in June, after a very slight downturn in deaths in May. Asia and South America began climbing in February and March, with Asia slowing slightly in June while South America climbed even higher, surpassing North America.

Back in October, Asia, Europe and the Americas were very close together in raw numbers. Europe and North America began a steady upward climb, well above the others, with Europe surpassing North America by December. January saw a slowdown for both, but North America slowed even more beginning in March, so the divide between them continued to grow. Europe did show a slight slowing in May, but became the first continent to surpass 1-million deaths (out of 3.6-million total)

South America started at a slower pace before bending upward more noticeably in March, then ending May poised to cross into second place as North America flattened. In June South America joined Europe in surpassing 1-millon deaths. Asia followed a similar pattern, though it was dropping further below South America until April when it started to rise, accelerating even more in May, then slowing in June. Asia could also pass North America in the next two or three months if present trends continue. Africa has remained the lowest and slowest in growth, ending June with 149-thousand deaths.

Comparison of U.S. with other Countries

Cases

USA stays #1, Argentina moves up two to #2, Belgium and France each drop one to #3 and #4, Brazil takes place of Spain at #5 (Brazil and Spain have traded #5)

The top-5 by proportion of population with COVID cases, have progressed at a rate higher than the Global level, but have stayed within a fairly narrow band. The U.S. reached #1 by December, continuing to climb at a very fast pace until starting to slow in January, bringing it closer to the others by the end of June. The others meandered a bit, began to appear as if they were spreading out by March, but drew closer together by the end of June. All are significantly higher than the global level of 2.3% cases as proportion of a country's own population.

Another way to look at population proportion is the measure "1 in." The global figure of 2.3% means that 1 in 43 people in the world have been reported with COVID (and that only by official record keeping, not including any unreported and likely asymptomatic cases). For the U.S. it is 1 in

10. For Brazil it is 1 in 11.

Canada replaces Iran in this month's list. The other four countries remain in the same order from May.

At the low end (Fig. 5B), the five lowest countries for cases by proportion of population are much closer to the global figure of 2.3% of population with confirmed cases of COVID-19 at the end of June.

While separated in May, Canada slowed while Bolivia continued to climb, so they ended up very close to each other at 3.8% and 3.7%. India had just moved into fourth place in May and even though it slowed in June, Mexico declined even more, widening their gap, though both are still under the Global level of 2.3% of their own population reported with COVID. Ecuador has stayed in the middle of the five, always above the Global level.

These countries represent a considerable spread in size, from India, the second largest country, to Bolivia, ranked number 50 of the 215 countries tracked by worldometers. For Canada, its 3.8% level represents 1 in 27 people, for India it is 1 in 45 and for Mexico it is 1 in 51.

Because the size of countries makes the use of raw case numbers illusory, another measure I find helpful is the rate of change from month to month (Figure 5C).

For this chart, countries are selected based on the change over two-months (end of April to end of June for this report). Except for the U.S. (which will appear every month), the mix has changed since the last report, with a tilt toward South America. India remains, but Turkey and Iran dropped from the top-5, replaced by Bolivia and Chile.

The overall trend (red line)

continues to go down. An upward turn last month was smoothed out when June turned downward. (A polynomial trend line flexes as adjacent data points go up and down, so the leading edge (newest dates) can change the shape of the curve as new months are added). Note that some months appear "flatter" than others, with less variations between countries and with the global (world) number.

India started below the Global level, then spiked significantly above it in April and May. While dropping down to 8% in June, India remains strong on the two-month change criteria because of its 49% change in May (it had the highest single month change, at 54%, in April).

The other four of the top-5 are all from South America and significantly above the Global level for May and June. Colombia had the highest change in June at 25%, plus 19% increases in both April and May.

The U.S. started above the Global level from November through January, then has fallen further below it each month since.

Deaths

Because deaths as a percentage of population is such a small number, the "deaths per million" metric provides a comparable measure.

Colombia replaces the UK this month while Peru moves to #1 because of a very large correction to its death numbers in June. Brazil, Belgium and Italy return from last month.

As Figure 6A shows, because of the enormous correction in Peru's death count, its Deaths per Million number soars above the others. At 5,749 it is nearly double Brazil and ten times to Global level of 508. In the worldometer list of all countries. I had to expand the chart vertically so you could still see some variations in the remaining countries.

Since this analysis focuses on 21 countries that have been in the top-10 of cases and deaths, there are 9 other countries with Deaths per Million between Peru and Brazil. The second place country at the end of June was Hungary (population 9.6-million) with a Deaths per Million of 3,113.

The other countries on the chart, including the U.S. are all above the Global level, and (except for Peru) fairly close to each other—closer than they were from December through March, when they started to close in on each other.

As observed last month, the overall trend shown in Figure 6A is that the US and UK (no longer in the top-5 of monitored countries), with aggressive testing and vaccination, are beginning to slow the death rate, while Europe (represented by Belgium and Italy) are just now beginning to slow. Even without Peru's astonishing correction, South America (represented by Brazil and Colombia) remains a trouble spot, more so statistically than Asia or Africa.

The same five countries, in the same order, continue in the lowest-5 in Deaths per Million (of the 21 countries tracked for this report).

Though starting to escalate in March, India remained well below the global rate of 508 deaths per million at the end of June. The other four countries are all above that rate. Canada has been slowing since February, Turkey rose in March and April, but slowed in June. Otherwise, Iran and Russia continue to climb above the Global rate.

As with the comparable chart for Rate of Change for Cases (Figure 5C), countries are selected based on the change over two-months (end of April to end of June for this report) in reported COVID deaths. Except for the U.S. (which will appear every month), the mix has changed since the last report, with Peru thrust into the lead with its huge correction of reported deaths, a 177% change from May. Bolivia also joined the top-5, with Turkey and Brazil dropping out.

The trend

in the rate of change in deaths (red line in Figure 6C) shows the delayed connection with cases. Monthly changes for cases trended down through May, then the 177% increase for Peru in June pushed the trend line slightly higher. (As mentioned with Rate of Change for Cases, the trend line is a polynomial that can change shape as new values are added at the most-recent end.)

An important comparison is individual countries each month against the global (World) level. As you can see, through March, with few exceptions, countries were below the Global level. That changed in April when four countries (Peru, India, Argentina, and Colombia) were all at or above the Global levell in May. For June all of the top-5, including Bolivia, were at or above the Global level.

The U.S. was higher than the Global level in December, January and February, then has been significantly lower since then, falling to a 1% change in June (over the number of deaths in May).

Mortality Rates (percentage of deaths against reported cases) have been slowly declining. This is not surprising as several factors came into play: the ratio of community spread versus outbreaks (nursing homes, similar confined settings) increased, lessons being applied to treatment, increased testing (which would expand the spread between reported cases and deaths), and increasing vaccinations since January (though that should impact both cases and deaths).

The top-5 in mortality rate (among the 21 countries observed) stand out because for the most part they had not been showing up in other charts until the past few months. All five countries carried over from May, with Peru jumping from #4 to #1. Peru had, like most other countries, seen a declining mortality rate which spiked in June due to adjusted numbers to nudge past Mexico (9.4% versus 9.3%) to take the lead. Both now share the distinction of being double the rest of the top-5. Except for a very slight upward move for Italy in June, the overall trend for the other three (Ecuador, Bolivia and Italy) has been down, but all above the Global level.

All five countries reappear this month, with Canada and France switching places.

France and Canada, continue to decline. The U.S. has leveled off at 1.8% for five straight months. India was trending down, then started a very slow increase in April. Similarly, Turkey hit a low in April, came up slightly in May, but stayed at 0.9% in June. All five were below the Global level of 2.2% in June.

How real is the threat of death from COVID? That's where successful mitigation comes in. Worldwide, by June, 1 in 1,976 people have died from COVID. In the U.S., while the mortality rate is low, because the number of cases is so high, 1 in 538 have died through June 2021. With low mortality, the U.S. should have been able to keep deaths much lower, but the extraordinarily high number of cases means more deaths. Without a better-than-global mortality rate, the U.S. death rate would be far higher. Compared to the 1918 pandemic, it could be ten times worse. The response of the health care system is part of keeping mortality down, but it's far too early to detail the cause for that positive piece of the COVID picture in the U.S. Even at the global mortality rate of 2.2%, the U.S. would have had 759-thousand deaths (for 34.5-million cases) by the end of June, instead of 620-thousand.

Tests

The same five countries remain on top in COVID testings, in the same order as May.

The U.S. remains ahead of other countries in reported COVID tests administered, at 505-million, 17% ahead of India, but that has narrowed from 39% last month and 56% in April. UK continues at the pace it set with an upturn in February, having moved past Russia in March. Russia and France continue on a steady upward path.

These are raw numbers, so it is important to recognize the size of the country. It is also the case that COVID tests can be administered multiple times to the same person, so it cannot be assumed that the U.S. has tested almost all of its population of some 330-million. Some schools and organizations with in-person gatherings are testing as frequently as once a week or more for those who are not yet fully vaccinated. That's a lot of testing!

Belgium traded places with Argentina, but the other four countries reappear in the same order. .

There is tremendous disparity between countries in terms of testing. Except for Belgium, the other four countries (among the 21 monitored) with the lowest reported number of tests are in South America.

Peru (14.1-million tests for its 32.9-million population) is well below Canada (37.6-million tests for its 37.7-million population). Ironically, even though they both fall in the bottom-5 by number of tests reported, Bolivia, with a population of 11.7-million has tallied 1.5-million tests, while Belgium, with 11.6-million people, has reported ten times that number, with 15.2-mllion tests.

Tests per million adds another perspective. Fig. 7C shows the five countries with the highest tests per million. All five appeared in the same order last month.

The UK, already the most aggressive in testing, increased its numeric lead each month since February, with a reported 3.11-million tests per million population in June, just over 3 tests per person. The U.S. continues on a straight line trajectory, reaching 1.52-million tests per million, more than one per person, with a very slight decline in June. France, Belgium and Italy track close to each other, all increasing their climb above 1-million tests per million in June. France, with some variance in its curve has wiggled its way from #5 to #3 since October, but the bottom four (of the top five) have tracked fairly close to each other in that time.

Anything over 1,000 represents more tests than people (1,000 on the chart actually means 1,000,000), but as mentioned above, that does not mean that everyone had been tested. Some people have been tested more than once, and some are being test regularly or with increased frequency.

The same five countries appear as the lowest five in tests per million in the same order as May.

While still at the bottom of the 21 countries monitored for this report, Iran and Brazil have made the most substantial progress, Iran in a steady and slowly accelerating curve, Brazil in more halting fashion that may indicate inconsistencies in reporting. Bolivia began to accelerate in March, so it now nearly double Ecuador which has moved more slowly steadily. Also taking a slow and steady approach is Mexico, with the lowest level of tests reported.

While improvement is evident in all five, the equivalent proportion of tests to population remains very low, from roughly 6% to 28%. This illustrates the arguments over inequity in resources among countries.

Causes of Death in U.S.

Early in the reporting on COVID, as the death rate climbed in the U.S., a great deal of attention was given to benchmarks, most notably as it approached 58,000, matching the number of American military deaths in the Vietnam War. At that time, I wrote the first article in this series, "About Those Numbers," in which I looked at ways of viewing the data, which at the time of that writing in May 2020 was still focused on worst-case models and familiar benchmarks, like Vietnam. Part of my approach in that article was to put the U.S. COVID deaths on a timeline against not only mileposts like war deaths or significant numbers (i.e., every 50,000 or 100,000), but against the reality of the top-10 causes of death each year, numbers available from the CDC.

Figure 8 shows the number of U.S. COVID cases and deaths against the top-10 causes of death reported by CDC for 2018 (the latest data available), along with several other mileposts from wars and the 1918 pandemic. Notice that for nearly nine months, the curve for deaths was increasing at a faster rate than cases. Then, starting in October 2020 the curve for cases took a decided turn upward, while deaths increased at a more moderate pace. (This month, I placed cases above deaths on the chart, which better matches the reality that deaths are a portion of cases, even though separate scales are used for each. That also allows the prediction cone to come closer to hitting its upper limit on the chart).

Most media sources reported that the U.S. would pass 500,000 deaths on February 22, 2021. The CDC reported 497,415 deaths on February 21, while worldometer.info was already reporting 512,068. As mentioned elsewhere in this report, worldometer tends to be about 3% ahead of CDC and Johns Hopkins, a matter of a few days difference in data collection. At any rate, it is clear that February 2020 saw the U.S. death toll from COVID pass the 500,000 mark, headed toward 600,000.

The February slowdown in cases was met by a barely perceptible slowdown in deaths, because as pointed out earlier, changes in deaths trail changes in cases. That trend continued in March and bent downward even more in April. In fact, if the trajectory from November to February had continued (the upper edge of the blue cone), we would have seen close to 925-thousand deaths by the end of June. The total of 610-thousand at the end of May did pass 599-thousand, the number who died from Cancer in 2018. The next benchmark is the #1 cause of death, heart disease, at 655-thousand. We're close, but the curve is bending down, so how long will it take to get there?

The latest "Ensemble Forecast" from CDC suggests this for the immediate future (even though worldometers is already ahead of this prediction, it is within the 3% difference between the two sources):

...the number of newly reported COVID-19 deaths will likely decrease over the next 4 weeks, with 600 to 2,900 new deaths likely reported in the week ending July 24, 2021. The national ensemble predicts that a total of 608,000 to 615,000 COVID-19 deaths will be reported by this date..

Note: As I've referenced in the notes for several charts, the data from worldometers.info tends to be ahead of CDC and Johns Hopkins by about 3%, because of reporting methodology and timing. I use it as a primary source because its main table is very easy to sort and provides the relevant data for these reports.

Perspective

The 1918-19 Spanish Flu pandemic is estimated to have struck 500 million people, 26.3% of the world population of 1.9-billion at that time. By contrast, we're now at 2.3% of the global population. Deaths a century ago have been widely estimated at between 50- and 100-million worldwide, putting the global mortality rate somewhere between 10 and 20-percent. It has been estimated that 675,000 died in the U.S.

IF COVID-19 hit at the same rate as 1918, we would see about 2-billion cases worldwide by the time COVID-19 is over, with the global population now at 7.8-billion—four times what it was in 1918. There would be 200- to 400-million deaths. The U.S. is estimated to have had 27-million cases (one-quarter of the population of 108-million) and 675,000 deaths. Today, with a population of 330-million (a three-fold increase from 1918) this would mean more than 80-million cases, and 2- to 4-million deaths.

However, at the present rate of confirmed cases and mortality while the total number of global cases could approach 500 million or more—comparable to 1918 in number, that would be one-quarter of 1918 when taking population growth into account . .. and assuming the pandemic persists as long as the Spanish Flu, which went on in three waves over a two year period. At the present rate of increase (approximately 12-million cases per month) it would take another 27 months to reach 500-million, well into 2024.

If the total number of cases globally did approach 500-million, using the global mortality rate of 2.2% in June, there would be roughly 11-million deaths worldwide, tragic but far below the number reported for 1918 (50-million) with an even wider gap (200 million) when taking population growth into account.

With vaccination in progress and expected to be completed in the U.S. by the end of summer, the end of COVID-19 could come sooner. Like 1918, however, there could be complicating factors such as the growing number of mutations that are more highly transmissible (but not necessarily more deadly). It seems unlikely that the number of cases worldwide will reach 500-mllion, unless current and potential hot spots in Asia, South America and Africa continue to grow. While we in the U.S. think the end of the pandemic is in sight (or already here), it is still too early to make predictions on the duration and severity of the COVID-19 pandemic globally.

The contrast demonstrates the vast difference in scale between the Spanish Flu pandemic a century ago and COVID-19 even a year-and-a-half in. Key differences are the mitigation efforts, available treatment today (though still leaving the health care system overwhelmed in some areas), and the beginning of vaccine distribution. In addition, in 1918 much of the world was focused on a brutal war among nations (World War I) rather than waging a war against the pandemic, which ran its course and was undoubtedly made much worse by the war, with trans-national troop movements, the close quarters of trench warfare, and large public gatherings supporting or protesting the war.

Vaccinations in the U.S.

With remarkable speed (it usually takes years to develop vaccines), two COVID vaccines were granted emergency approval for use in the U.S. starting in January—the one by Pfizer requires super-cold storage, which limits its deployment. The other, by Moderna, requires cold storage similar to other vaccines. Both of these require two doses, which means that vaccine dosages available must be divided in two to determine the number of people covered. By my March report, Johnson & Johnson had been granted approval for a single-dose vaccine. The numbers in Figure 9 represent the status of all three vaccines as of June 30.

A person is considered "fully vaccinated" two weeks after the final (or only) vaccine dose; that means it can take a total of 5 or 6 weeks from the first of a two-dose vaccine to be fully vaccinated. (depending on the time between doses).

Early on (still somewhat evident in March) there was much anxiety about vaccine availability and scheduling appointments. That is behind us and vaccinations are readily available to most of the population (there will always be some disparities and trouble spots, but in general most people who want the vaccine can get it).

Now, the biggest concern is convincing the dubious, the deniers, and the resisters to get vaccinated and help the country reach herd immunity (about 70% of the population fully vaccinated). Some of the latest strategies to encourage vaccination is the provision of incentives, from free beer to lotteries for the fully vaccinated.

Vaccinating over 300 million people in the United States (much less a majority of the billions around the world) is a daunting task. It is a huge logistical challenge, from manufacture to distribution to administration. Yet, it remains amazing that any of this is possible so soon after the identification of the virus a year and a half ago.

There is a delicate balance between maintaining hope with the reality that this is a huge and complicated logistical operation that will take time, though that time is now measured in months instead of years. As the richer countries with access to more resources make progress, the global situation is raising issues of equity and fairness within and between countries.

Even as the U.S. and other countries launch large scale vaccine distribution to a needy world community, the immensity of the need is so great that a common refrain heard now is whether this aid is too little, too late. As COVID fades into a bad memory in countries able to provide help, will the sense of urgency remain high enough to produce the results needed to end this global pandemic?